In a digital environment, the new relationships established between financial institutions and their consumers are based on both trust and convenience, but establishing this trust, namely through KYC processes, often comes at a steep cost.

Trust goes both ways; customers need to trust businesses, but businesses need to know their customers

There is no question that trust has to go both ways. Customers want to trust businesses for their online transactions because they like their products or services, or they feel an affinity for the brand and that the business will protect their personal and financial details. On the other hand, companies establish trust in their customers when they know them, which means that they have been able to identify them and that they are who they present themselves to be, and not a fraudster impersonating a good customer.

But the need for this verification of identity goes even further: Companies, especially financial entities, are obliged by regulatory bodies to comply with the requirement to meet KYC (“Know Your Customer”) — not just to avoid losses due to fraud — but to prevent money laundering and the funding of terrorism, among other financial crimes — and ultimately, to protect society.

So how much does it cost to know your customer?

Therefore, this verification of a customer’s identity is both a strategic necessity and a legal imperative. But this process, just like any other, comes at a price: How much does it cost to really get to know your customer?

It is with this question in mind that Consult Hyperion’s newest study explores “The cost of compliance and how to reduce it.”

The study examines some of the key elements that drive the costs associated with KYC compliance, goes beyond just the process itself but also dives into areas like the following:

Internal costs, external costs and sanctions

Internal costs are those that are directly associated with the verification process, in systems as well as in staff and the office network where “hundreds, and in some cases thousands, of compliance staff are employed to monitor transactions, deal with alerts, work cases, phone customers, and deal with false positives.” The combined cost of staff and systems contributes the highest cost to the equation. Consult Hyperion estimates, for a typical bank with 10M customers, a KYC programme can have internal costs of up to €25M.

External costs can vary from country to country and includes costs like access to the necessary databases for carrying out the KYC process. In this case, the approximate cost is calculated at €5M.

The last two areas are the most difficult to predict or quantify for the entity but still represent very real costs. On the one hand, consider the possible sanctions in the event that the process fails or is not being applied correctly. And on the other, consider the cost of lost opportunities, that is, when potential customers leave the onboarding process due to the friction caused by the identification process.

It is true that users will accept a certain degree of friction in the process, since it will increase their perception of security. However, if the process is too slow or complex, they will most likely leave — for another entity.

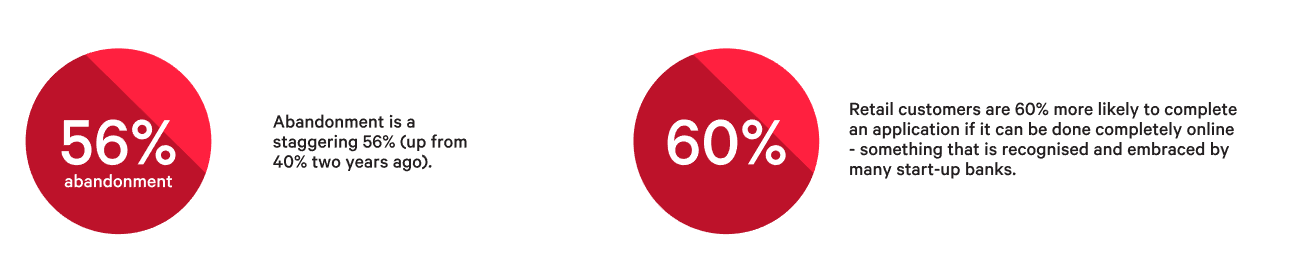

According to a study by Sapio, "The Battle to Onboard 2 Research Report," the abandonment rates in an onboarding process can be staggeringly high, although they do decrease significantly if the user can complete the process entirely online:

Reduce compliance costs and diminish abandonment

With this lens, the Consult Hyperion study, “The cost of compliance and how to reduce it” finds that with the right technology, financial entities can reduce the costs of compliance with KYC requirements by up to 20%, and since dependence on manual verifications is reduced, it diminishes the cost of lost opportunities and there are fewer errors in complying with the standard, which in turn results in lower negative impact, both economically and with regard to consumer trust.

To dive deeper into the real cost of KYC compliance and how to reduce it, download the Consult Hyperion study, here: