“Among FIs offering and tracking business mobile banking adoption, more than half (55 percent) still have adoption rates less than five percent.” This is one of the findings of a recently released survey by the Federal Reserve Bank of Boston, offering an overview of mobile banking and mobile payment adoption.

For those of us who have been in the mobile financial services world for a while, reporting adoption rates of less than 5% for business apps is one of those shockingly low numbers that fails to shock. In fact, one of the paradoxes of the current business banking landscape is that C2B and B2B checks account for roughly two-thirds of all check deposits, with checks here to stay for the foreseeable future.

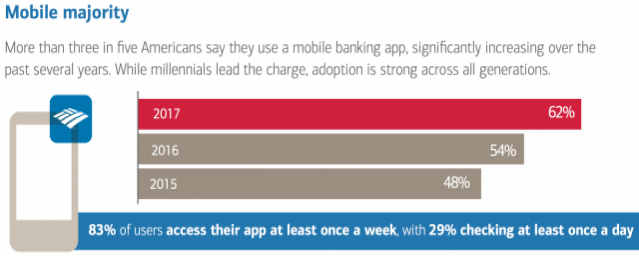

The Boston Fed’s report also states that “Of those FIs tracking customer adoption, 54 percent now have more than 20 percent of their retail customers enrolled in mobile banking; and 44 percent have more than 20 percent actively using these services.” However, there are many reports, such as Bank of America’s Trends in Consumer Mobility one, that place mobile banking usage in the U.S. at about 62%

Leveraging mobile deposit to drive adoption of digital banking

Source: Bank of America Trends in Consumer Mobility Report, 2017

Of course, 62% is greater than 20%, but with apologies to the Fed, I think this one is off somehow. I often detect a laissez-faire attitude on the topic of digital adoption in many banks, which is counter-intuitive given how vital it is to the success of any FI. Decades in this trade tell me that financial institutions should pay close attention to their rate of check deposits in the mobile channel as it is a clear indicator of progress towards broader digital adoption.

Leveraging mobile deposit to drive adoption of digital banking

Leveraging mobile deposit to drive adoption of digital banking

Let’s take a look at how financial institutions should think about success, how it looks like, and how to achieve it:

- Set a comparative benchmark. As a large financial institution, you should report your adoption numbers to analysts (see slide 21 here for a great, recent example); furthermore, you should be tracking those. Also, vendors can often give you a good idea of how you’re doing comparatively.

- Review, improve, and analyze the user experience. Banks should ask themselves what happens when a customer walks into the branch. The correct answer is “they are met by a representative with a tablet”. Increasingly known as ‘digital ambassadors’, these branch employees not only begin to help the customer but are also helping themselves by walking the customer through using their own mobile device. These digital advocates set customers for success, enabling them to start benefiting from services such as mobile check deposit.

- Update the definition of ‘booked account’. To determine if a new account has been completely opened or ‘booked’, banks tend to confirm that the account is funded (many new accounts are ‘ghost accounts’ that never get funded). In order to close the cross-channel customer experience, successful FIs are incorporating new KPIs. For example, I have recently advised a bank on their digitalization, so their onboarding process now includes “do one mobile deposit with the customer”. Branch employees have pre-printed low dollar checks at the ready for this purpose and are not credited with a fully opened account until this step is completed.

- Define success: What does success look like to you, and who in your institution agrees (or disagrees) with you? I often detect a laissez-faire attitude on the topic of digital adoption in many banks, which is counter-intuitive given how vital it is to the success of any FI. When asked their opinion that, say, 12% of checks being deposited by their retail customers are coming in via the mobile channel, I’ve heard sounds of contentment and pride. But many banks are above 20%, and frankly, the numbers should be well north of 30%. Frankly, 15% or 20% mobile penetration for check deposits doesn’t look like success. Establishing an aggressive number, getting all stakeholders on board, and getting inspired by those ahead of the pack are the building blocks to create momentum.