To date, financial institutions in the UK have been largely unsuccessful with their efforts to attract Millennials. Despite the causes for this failure to build rapport with most coveted demographic have been explored in some depth, no real insights have been translated into a successful business strategy for financial institutions as yet.

A new survey of 1,001 UK Millennials conducted by Osterman Research found that part of the problem lies with the fact that financial institutions have been focusing their marketing efforts on the wrong segment of this demographic: younger Millennials – those aged 18 to 22 years – who are not yet financially independent.

Today, quite a growing number of Millennials are living at home with their parents, many are still paying for education, and they are generally more concerned with entertainment and paying rent than in financial services.

Financial services don’t become a necessity for Millennials until they reach their late twenties. But even then, it’s hard for financial services providers to attract the interest of busy and always on the move 29 to 34 years old consumers.

Key reasons why banks in the UK are targeting the wrong people, in the wrong place

Download Misunderstood Millennials: Have Financial Institutions Got it Wrong?, the latest survey addressing the financial priorities and technology preferences of today’s largest demographic, and discover key misconceptions banks and financial services providers in the UK share about Millennials, their needs, their priorities ,and their desires.

Some of the main findings of this Osterman Research Survey Report:

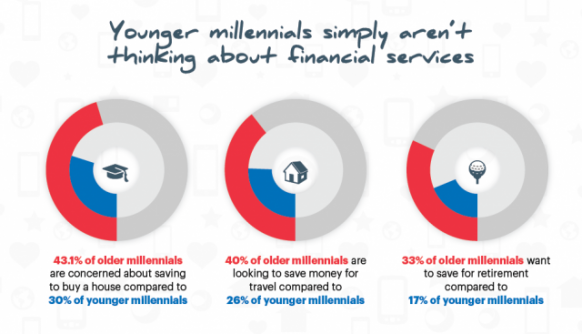

• Younger Millennials are not focused on financial services. In fact, 48% of younger Millennials are concerned about paying for their education and 30% have enough with figuring out ways to pay for their future home.

• Counterintuitively, mobile is more important for older Millennials than for young Millennials: Older millennials are five percent more likely to use their phones to apply for services or purchase goods than younger millennials, but more than one in five older Millennials make at least one purchase on their mobile per day, compared to 12 percent of younger Millennials.

• Despite general belief, security and not convenience, tops older Millennials’ concerns, with 43% of the oldest end of this age range worrying about ID fraud or data security prevent them from making transactions on their mobile device, compared to 33 percent to 39 percent of younger Millennials.

• 55% of younger Millennials see the camera function as a very or the most important function of their mobile device compared to a whooping 73% of older Millennials.

• Older Millennials love selfies and want them to be an identity method to alleviate security fears. According to Osterman research, older Millennials are around 25% more likely to use their camera to fill in personal information or verify their identity using a selfie or a photo of their ID documents.