The changes that are happening to the banking industry are apparent to all of us. The same forces that have been reshaping retail, journalism, automobiles and every other industry are at play in financial services. And while times of great change like this always bring with them some degree of alarmism (e.g. banks are going to be put out of business by a host of new-economy start-ups, branches are going to disappear completely, etc), it is apparent that a great separation is underway, where tomorrow’s winners are making certain moves today to extend their lead over their competition.

The axis upon which this separation is happening is digital. Banks need to increase their digital offerings and capabilities for a long list of reasons. Here are some of them:

- Millennials are establishing their banking relationships based largely upon banks’ perceived digital sophistication. And as we know, once established, banking relationships tend to be sticky.

- As one banker pointed out to me, the most active digital customers tend to have the highest Net Promoter Scores.

- The presence of digital services drives cost out of the business. Banks who are able to accomplish this will enjoy higher efficiency ratios and stronger organic growth.

In the United States, no digital service has garnered as much enthusiasm from consumers as mobile check deposit, an innovation that is being actively and enthusiastically used by tens of millions of customers today. In fact, many mobile banking solutions were procured by banks not because customers were emphatically demanding the ability to see their balance on their phone, but instead to be able to deposit a check from any where, any time.

And so the banks rolled their service out, but in the frenetic pace of the banking industry the banks integrated the service and, for the most part, believed that they had done a good job and turned their attention elsewhere. Meanwhile, new customers aren’t aware of the service, interested customers are nervous about using it for the first time and and need some reinforcement, and the Customer Experience (CX) delivered to active users received little attention.

And so the banks rolled their service out, but in the frenetic pace of the banking industry the banks integrated the service and, for the most part, believed that they had done a good job and turned their attention elsewhere. Meanwhile, new customers aren’t aware of the service, interested customers are nervous about using it for the first time and and need some reinforcement, and the Customer Experience (CX) delivered to active users received little attention.At Mitek, we decided to sponsor research that would indicate the degree of differentiation between the largest banks’ mobile deposit solutions. We further wanted to see if there was any correlation between the quality of a bank’s CX and their customer adoption. We didn’t have a vested interest in the outcome, and we needed the work to be rigorous and fair.

That research is completed, the report is freely available, and the results, to put it mildly, were interesting.

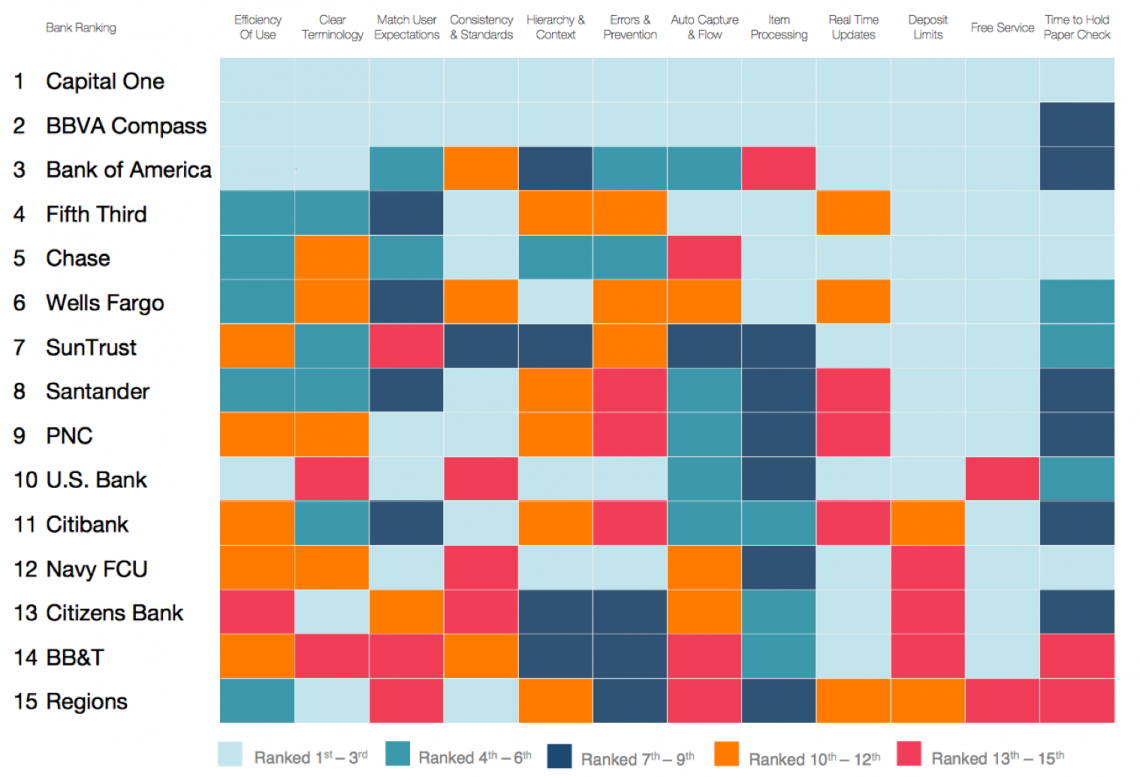

Futurion, a research firm founded by Jim Van Dyke, who was the original founder of Javelin Strategy, and Comrade Agency, a CX specialist agency in the Silicon Valley area, teamed up to evaluate the CX for the mobile deposit apps of fifteen of the largest US Financial Institutions (FI”s). The research investigated nine CX categories and three policy categories, and further correlated those scores against the FIs’ customer adoption of Mobile Deposit.

The report can be downloaded for free here. It represents a big step forward for the industry at a time when a customer’s mobile deposit experience is likely a leading indicator of their overall digital experience with the bank, and their overall digital experience is a leading indicator of the degree to which the bank is poised for the future. As the report indicates, not all banks are setting themselves up for success (by the way – congratulations to top-rated banks Capital One, BBVA Compass, and Bank of America).

Our Mobile Deposit solution has processed over 1 Billion check deposits, and along the way we’ve learned a lot with the industry and see some important trends developing. Some high-level examples:

- At this point, if a bank doesn’t offer auto-capture for Mobile Deposit – where a user can now “hover” their phone over the check and have it automatically find the edges and take a perfect picture in all sorts of challenging conditions – then their service is lagging.

- If the Risk and Compliance group in the bank has compelled the service to have low limits on the value of a check the bank will accept via the mobile channel, then they have worked against the interests of the bank and are driving customers to a more inconvenient alternative (driving to a branch or ATM).

- If the lawyers are writing the post-capture instructions that is presented to a customer after the check is captured and accepted by the bank (“e.g. write ‘electronically presented’ on the check and store in a secure location for 60 days”), then the bank isn’t being serious about CX. Who wants to receive a message like that after the bank’s own application indicated the check has been received cleanly by the app?

There is more, and there will be more. We are serious about providing thought leadership and insights to this industry. There will be new versions of this report in the future. Will the banks improve their CX in the meantime?

There is more, and there will be more. We are serious about providing thought leadership and insights to this industry. There will be new versions of this report in the future. Will the banks improve their CX in the meantime? As is the case with the entire banking industry, the future is unclear, but it’s going to be interesting to watch.

About Michael Diamond

General Manager, Payments Solutions. Mike leads the team that invented, patented, and now develops and markets the most exciting mobile product to hit banking: Mobile Check Deposit. Mitek’s payments team is committed to leveraging mobile capture in new ways to delight mobile users.

A former Military Intelligence Officer in the USAR and is a veteran of Operation Desert Storm, Mike has grown innovative technology companies such as Obopay, IBM, Alphablox, S1 and Edify.