We know that desktop applications still make up 40 – 50% of all digital applications. But identity verification is a problem. Customer frustrations when opening a new account can be corrected by creating an integrated onboarding process that easily crosses systems as the customer moves through each step.

Currently, customers who attempted to open an account through a digital channel and failed, normally complain about an inability to complete the process end-to-end without being forced into another branch or call center. Recent search shows that 58% of them had to go to the branch for identity verification, not only adding up to their increasing frustration, but also costing more to the bank because opening an account online is, on average, $55 cheaper than in the branch.

Increasing customer satisfaction with the omnichannel onboarding process will ensure consumer follows through instead of dropping a new account application when one of the aforementioned issues appear. Furthermore, other hurdles such as legacy systems and information siloes can be effectively overcome with an outstanding user experience.

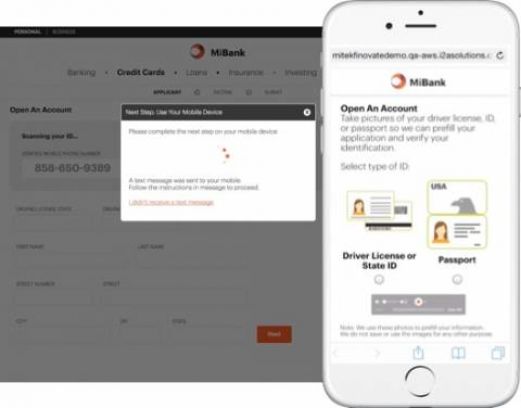

Our Mobile Verify solution address these pain points with a new desktop-to-mobile identity verification widget that can be easily integrated into your desktop work flow.

Outstanding omnichannel account opening with desktop-to-mobile identity verification

So, how does the enhanced Mobile Verify with desktop-to-mobile capabilities work?

So, how does the enhanced Mobile Verify with desktop-to-mobile capabilities work? - Your potential customer finds you after browsing the Internet and goes to your web to open a new account.

- Prospect begins desktop applications and is asked for proof of valid ID.

- To start the process, the user enters his mobile phone number into the field prompted on his desktop application.

- A text message will be sent to his mobile device.

- The text message will have a link the user can click on to open a mobile capture experience to satisfy that requirement.

- The smartphone’s owner can choose from a driver license, ID card, or a passport. As a truly global platform, Mitek’s technology supports thousands of ID documents from around the world.

- Once the user has taken a valid photo of the front of his identity document of choice, he will be asked to capture an image of the back of his ID document as well and this one will go also through numerous image quality tests within milliseconds. Mobile Verify provides real-time feedback along the entire process to ensure that high quality images are captured, substantially reducing the time needed to complete this step and improving the overall user experience.

- When both images are captured, they are optimized for fast transmission to the Mitek cloud which assess them for authenticity.

- Mobile Verify detected that this user started his session at his desktop, so once it’s done processing, it will automatically deliver the data extracted to the user’s channel of choice, desktop in this case.

- We also return fast and accurate data that prefills the form thanks to the integration of Mobile Fill, so you can deliver an even more convenient account opening experience.

After finalizing this 10-step process, you will get less typing, a better mobile user experience, a very strong ‘what you have’ factor of identity verification and a truly omnichannel onboarding experience.